HOW DOES PROBATE WORK?

The probate process is overseen by the Probate Court, and it transfers a deceased person's property(the “decedent estate”) to heirs or beneficiaries through a valid will or intestate succession (without a will).

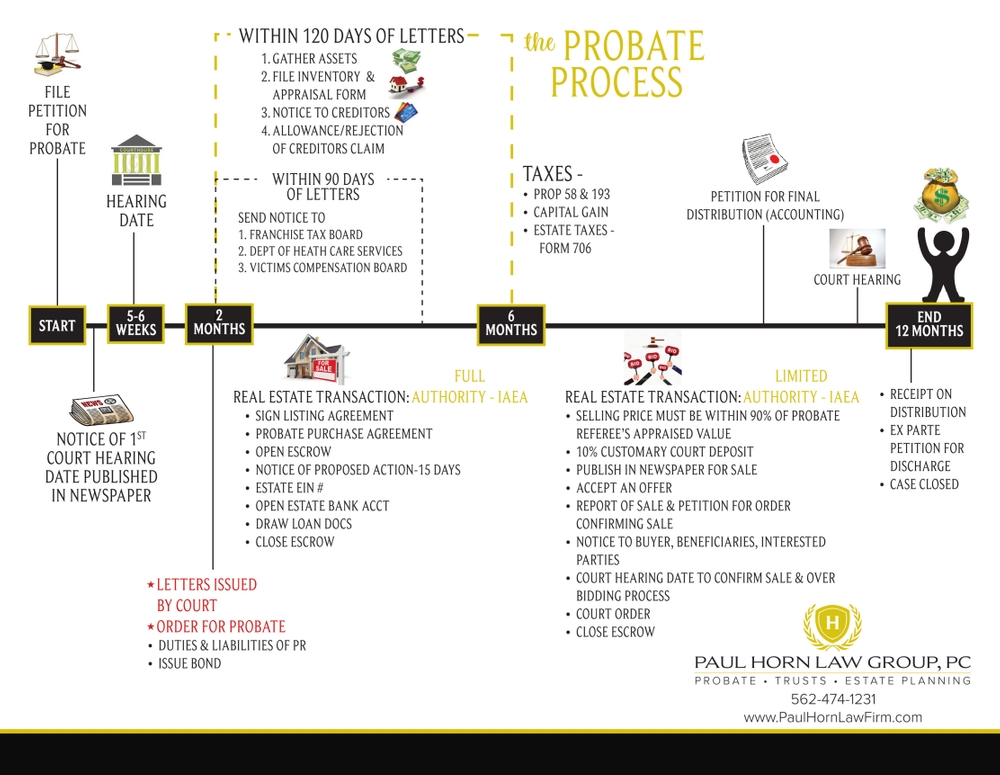

- The probate process begins with the filing of the "Probate Petition" at the courthouse.

- A notice of the first court hearing date is then published in a newspaper of general circulation in the decedent's resident city, and it is mailed to all heirs and named beneficiaries. This action takes place promptly after the Probate Petition and it can be filed by your probate lawyer or you as the petitioner.

Vanessa L. Klein, Realtor

COURT HEARING

2. A Probate hearing occurs approximately 5 weeks following the filing of the Probate Petition. This hearing enables the court to officially designate the individual responsible for managing the distribution of assets and other tasks related to settling the estate.

During a probate hearing, the court appoints an executor (if there is a will) or an administrator (if there is no will) as the personal representative of the decedent. This appointment authorizes the personal representative (PR) to handle the deceased person's estate.

A few weeks after the court hearing

3. Approximately 60 days after filing the Probate Petition an Order for Probate signed by the judge appoints the Personal Representative (as executor or administrator).

The Personal Representative must have the authority to act. This authority is granted by the Court when Letters Testamentary or Letters of Administration are issued. - Probate administration begins.

Letters of Probate Authority:

- Letters of Testamentary (with a will)

- Letters of Administration (without a will)

The court issues a certificate specifying that designation; these are the "letters" required by banks, title companies, realtors, etc., before listing a home, granting access to any assets or debts of the decedent.

Letters specify the name of the Personal Representative and if their authority is:

- Full authority or

- Limited authority

It is granted under the Independent Administration of Estates Act (IAEA).

SELLING A PROBATE PROPERTY

Once you have been appointed as the executor or administrator of the estate, you have the authority to hire me as real estate agent and sign a listing agreement for an initial period not exceeding 90 days. It will be my job to guide you through the process and work closely with your attorney to ensure all legal requirement are met.

Things to know when selling under Full Authority

- Sign listing agreement for a period no longer than 90 days.

- Sign probate related documents and addendums as well as representative capacity form.

- One or more 90-days listing period extensions are permitted.

- Obtain from the Internal Revenue Service a "Tax Identification Number" for yourself as Personal Representative of the decedent's estate.

- Open estate bank account.

- Decide on repairs see our Fix before you Sell program that allows you to make repairs and pay for the repairs at the closing.

An executor or administrator under IAEA is required to give Notice of Proposed Action for further listing extensions once 270 days have passed.

Things to know when selling under Limited Authority

- Under Limited Authority, the court oversees the sale.

- A probate referee will provide an estimate of the appraised value.

- A 10% deposit is required to be submitted with all offers.

- The offer is subject to court's confirmation. While as the seller you may have accepted a buyer's offer, the commitment to that buyer or their offer is not finalized. Your probate attorney will subsequently request the court to confirm the sale. A future date is selected for the court to confirm the sale.

- After setting the sale date, there's a required 30 to 45-day wait. The court mandates proper advertising and marketing of the property with the new accepted price.

- A buyers' offer is subject to overbidding during the court hearing.

- If there are overbids the court establishes the minimum increment and continues accepting bids until the highest bid is reached.

- To confirm the sale, the court requires new buyers and interested parties to attend probate court.

The property is then offered with an opening bid set at the accepted offer price.

Plus 10 percent of the first $10,000 of the original accepted offer price.

Plus 5 percent, accepted offer price minus $10,000 (in California.)

For instance: An accepted offer $500,000 (10% of 10,000= $1,000) + ($490,000 x 5%)

- If there are no overbidders the original buyer can proceed with the purchase and the judge will confirm the sale.

OTHER THINGS TO CONSIDER

Anticipate these costs:

- Attorney Fees if one is being used.

- Personal Representative Compensation: often around 5 to 6 percent of the estate value, as compensation for the Executor or Administrator.

- Probate Bond: Unless your Will specifies otherwise. Often required for out of state Personal Representatives.

- Court Fees: Filing fees vary by county depending on the probate filing location.

- Creditor Notice Fees: Expenses associated with filing notices to creditors and beneficiaries, typically announced in local newspapers, are covered by the estate.

- Real Estate Sales Fees

Declaration of Heirship:

- If the person died without a will (also known as "dying intestate"), the applicant must pursue a court declaration of heirs through a process called "Declaration of Heirship." While an administrator can be appointed before determining heirs, the distribution of assets depends on the court's determination. In specific situations, applicants can expedite the process by filing a joint application for both Letters of Administration and Declaration of Heirship, saving valuable time.

Do you qualify for a simplified process for transferring personal property?

Copied from: California Courts

"First, figure out if the value of all the decedent’s property (the estate) is $166,250 or less. To do this:

Include:

- All real and personal property.

- All life insurance or retirement benefits that will be paid to the estate (but not any insurance or retirement benefits designated to be paid to some other person).

Do not include:

- Cars, boats or mobile homes.

- Real property outside of California.

- Property held in trust, including a living trust.

- Real or personal property that the person who died owned with someone else (joint tenancy).

- Property (community, quasi-community, or separate) that passed directly to the surviving spouse or domestic partner.

- Life insurance, death benefits or other assets not subject to probate that pass directly to the beneficiaries.

- Unpaid salary or other compensation up to $16,625 owed to the person who died.

- The debts or mortgages of the person who died. (You are not allowed to subtract the debts of the person who died.)

- Bank accounts that are owned by multiple persons, including the person who died."

Source: California Courts